Is it true or not that you are keeping a heartbeat on the financial scene? In the present high speed monetary world, understanding the most recent US CPI expansion information is critical. It’s not simply numbers on a graph; it’s the heartbeat of market patterns, speculation procedures, and financial gauges.

Table of Contents

Introduction

In our current reality where monetary dependability is central, it is critical to figure out financial markers. Among these, the Purchaser Value File (CPI) remains as a point of support, offering bits of knowledge into the changes of costs for labor and products. This guide dives profound into the complexities of US CPI expansion information, unwinding its importance, patterns, and suggestions.

What is CPI?

The CPI estimates the typical change in costs paid by purchasers for a crate of labor and products over the long run. It fills in as a crucial device for financial specialists, policymakers, and financial backers to measure inflationary tensions inside an economy.

Significance of CPI

CPI information gives pivotal bits of knowledge into the buying force of shoppers, influences on financing costs, and the general strength of the economy. Understanding CPI helps in going with informed choices in regards to ventures, money related arrangements, and business methodologies.

CPI Computation Procedure

The Department of Work Measurements (BLS) computes CPI in view of a weighted normal of different classifications like lodging, transportation, food, and clinical consideration. Every classification holds an alternate load in the record, mirroring its significance in shoppers’ spending plans.

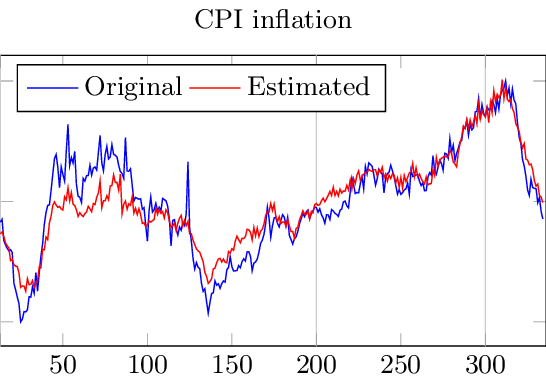

Patterns in US CPI Expansion Information

Breaking down authentic patterns in CPI information reveals critical examples and changes in the economy, directing future gauges and strategy changes.

Verifiable Investigation

By looking at CPI information throughout various time spans, one can recognize long haul patterns, occasional changes, and monetary cycles. Authentic examination helps with understanding what inflationary tensions have advanced and meant for purchaser conduct.

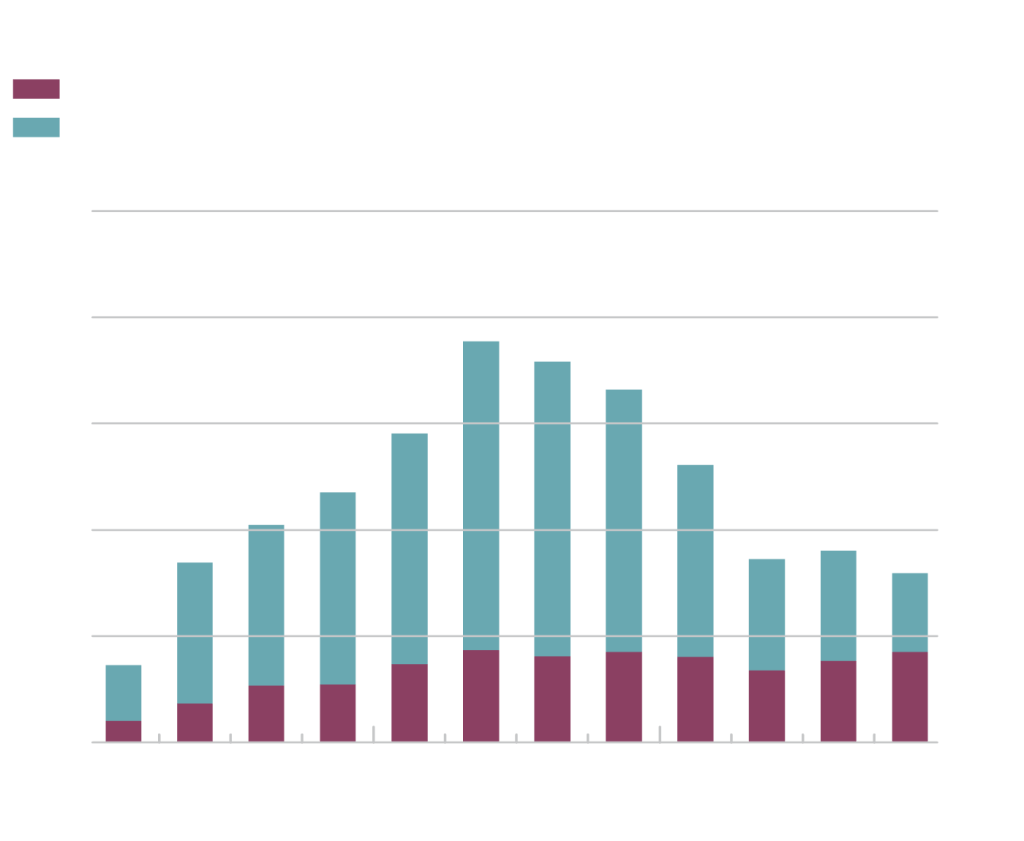

Occasional Varieties

Certain labor and products show occasional cost changes because of elements like weather conditions, occasions, and supply-request elements. Understanding these varieties assists in anticipating with shorting term expansion drifts and changing procedures appropriately.

Financial Cycles

CPI information frequently relates with financial cycles, like times of development, downturn, and recuperation. Breaking down CPI patterns inside these cycles gives bits of knowledge into the general wellbeing and bearing of the economy.

Factors Affecting CPI

A few elements add to changes in CPI information, going from worldwide financial circumstances to homegrown strategy choices.

Market interest Elements

Changes in production network disturbances, mechanical progressions, or changes in customer inclinations can affect the costs of labor and products, impacting CPI patterns.

Financial Arrangement

National banks’ choices with respect to loan costs, cash supply, and quantitative facilitating measures straightforwardly impact inflationary tensions, reflecting in CPI information.

Government Approaches and Guidelines

Financial arrangements, charge changes, and administrative changes sanctioned by states can have expanding influences on costs, in this way influencing CPI patterns.

Deciphering CPI Information

Deciphering CPI information requires a nuanced comprehension of monetary pointers and their more extensive ramifications on different partners.

Inflationary versus Deflationary Tensions

Rising CPI shows inflationary tensions, possibly prompting expanded loan costs and diminished buying power. On the other hand, declining CPI means deflationary dangers, inciting policymakers to carry out boost measures.

Influence on Ventures

Financial backers intently screen CPI information to survey the effect on resource classes like stocks, bonds, and wares. Inflationary conditions might incline toward substantial resources like land and valuable metals as supports against buying power disintegration.

Purchaser Conduct

CPI information impacts purchaser opinion, spending examples, and reserve funds propensities. High expansion rates might provoke buyers to change their spending plans, focus on fundamental costs, and look for better return ventures.

Gauging Future Patterns

Foreseeing future CPI patterns requires a mix of financial investigation, information displaying, and situation arranging.

Financial Markers

Looking at proactive factors, for example, business levels, wage development, and assembling yield gives bits of knowledge into likely inflationary tensions.

Worldwide Monetary Variables

Worldwide occasions, like international pressures, economic deals, and cash variances, can gush out over into homegrown CPI patterns, requiring a more extensive point of view in determining.

Strategy Reactions

Expecting national bank activities, government boost bundles, and administrative changes empowers partners to plan for possible changes in CPI elements.

FAQs:

What is US CPI expansion information?

US CPI (Buyer Value List) expansion information estimates changes in the costs paid by shoppers for labor and products over the long run. It is a critical sign of inflationary patterns in the US.

For what reason would us say us is CPI expansion information significant?

US CPI expansion information gives significant experiences into the condition of the economy, helping policymakers, organizations, and financial backers settle on informed choices. It influences loan costs, buyer spending, speculation systems, from there, the sky is the limit.

Where might I at any point track down US CPI expansion information?

US CPI expansion information is ordinarily delivered by government organizations like the Department of Work Measurements (BLS) and is generally accessible through monetary media sources, government sites, and financial examination firms.

Conclusion

The US CPI expansion information fills in as a fundamental gauge of financial wellbeing, directing choices across areas and enterprises. By grasping its complexities, breaking down verifiable patterns, and deciphering future conjectures, partners can explore the always changing financial scene with certainty and lucidity. Remain informed, remain cautious, and let CPI information be your compass in the excursion towards monetary strength and thriving.